Page 13 - Mines and Minerals Reporter eMagazine - Volume October 2021

P. 13

INDUSTRY ANALYSIS

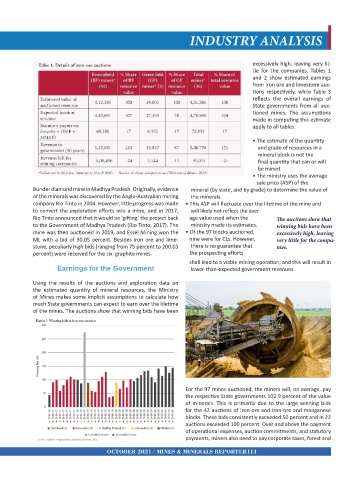

excessively high, leaving very lit-

tle for the companies. Tables 1

and 2 show estimated earnings

from iron ore and limestone auc-

tions respectively, while Table 3

reflects the overall earnings of

State governments from all auc-

tioned mines. The assumptions

made in computing this estimate

apply to all tables:

• The estimate of the quantity

and grade of resources in a

mineral block is not the

final quantity that can or will

be mined.

• The ministry uses the average

sale price (ASP) of the

Bunder diamond mine in Madhya Pradesh. Originally, evidence mineral (by state, and by grade) to determine the value of

of the minerals was discovered by the Anglo-Australian mining the minerals.

company Rio Tinto in 2004. However, little progress was made • This ASP will fluctuate over the lifetime of the mine and

to convert the exploration efforts into a mine, and in 2017, will likely not reflect the aver

Rio Tinto announced that it would be ‘gifting’ the project back age value used when the The auctions show that

to the Government of Madhya Pradesh (Rio Tinto, 2017). The ministry made its estimates. winning bids have been

mine was then auctioned in 2019, and Essel Mining won the • Of the 97 blocks auctioned, excessively high, leaving

ML with a bid of 30.05 percent. Besides iron ore and lime- nine were for CLs. However, very little for the compa-

stone, peculiarly high bids (ranging from 75 percent to 200.05 there is no guarantee that nies.

percent) were received for the six graphite mines. the prospecting efforts

shall lead to a viable mining operation, and this will result in

Earnings for the Government lower-than-expected government revenues.

Using the results of the auctions and exploration data on

the estimated quantity of mineral resources, the Ministry

of Mines makes some implicit assumptions to calculate how

much State governments can expect to earn over the lifetime

of the mines. The auctions show that winning bids have been

For the 97 mines auctioned, the miners will, on average, pay

the respective State governments 102.9 percent of the value

of minerals. This is primarily due to the large winning bids

for the 42 auctions of iron-ore and iron-ore and manganese

blocks. These bids consistently exceeded 50 percent and in 22

auctions exceeded 100 percent. Over and above the payment

of operational expenses, auction commitments, and statutory

payments, miners also need to pay corporate taxes, forest and

OCTOBER 2021 / MINES & MINERALS REPORTER 11